|

| |

|

Polson Bourbonniere Financial

Planning Group Inc.*

DWM Securities Inc.

7050 Woodbine Ave., Suite 100

Markham, Ontario L3R 4G8

Main: 416.498.6181 or 905.413.7700

Fax: 905.305.0885

Toll Free: 1.800.263.0120

Website: www.worryfreeretirement.com

Ruth Ashton, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7710

E-mail: rashton@pbfinancial.com

Paul Bourbonniere, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment & Insurance Advisor

Direct: (416) 498-6181

E-mail: pbourbonniere@pbfinancial.com

Lydia Bzowej, BA, CFP®, EPC

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7703

E-mail: lbzowej@pbfinancial.com

Allan Kalin, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7706

E-mail: akalin@pbfinancial.com

Derek Polson, CFP®

Certified Financial Planner

Investment & Insurance Advisor

Direct: (905) 413-7709

E-mail: dpolson@pbfinancial.com

Kirk Polson, CFP®, CLU, CH.F.C.

Certified Financial Planner

Investment & Insurance Advisor

Direct: (416) 498-6181

E-mail: kpolson@pbfinancial.com

Office Hours

Monday to Friday,

8:30 a.m. - 5:00 p.m. |

| |

|

|

|

|

Kirk Polson, CFP®, CLU, CH.F.C.

New Planning Opportunities New Planning Opportunities

In last year's Federal Budget, significant changes to Old Age Security (OAS) were announced. Most prominent was the raising of the qualification age for Old Age Security benefits from 65 to 67. Given less attention in the media was the ability, beginning July 1, 2013, for those of you turning age 65 to elect to defer your OAS benefits for up to 5 years. This voluntary deferral provision presents significant planning opportunities; pre-retirees should be aware of these as they approach retirement.

Let's take a look at the OAS changes and how they will impact you. Let's first point out, however, that these changes do not affect those of you who already receive OAS.

OAS is financed from general government revenues and provides a monthly income to Canadians age 65 and over. The maximum monthly benefit for the first quarter of 2013 is $546.07 ($6,553 annually), and is subject to quarterly indexing. In the Economic Action Plan 2012 it was announced that with Canadians living longer and healthier lives, the changes "are necessary to ensure that the OAS program remains on a sustainable path. They will ensure that OAS remains strong and is there for future generations when they need it...". No doubt factoring into the decision was that many other countries, including Australia, USA, and a number of European countries, are increasing the age of eligibility for their public pension programs.

Increase in Age of Eligibility

Starting on April 1, 2023, the age of eligibility for OAS benefits will be gradually increased from 65 to 67, with full implementation by January 2029. By giving an 11-year advance notification, and providing for a 6-year phase-in period, Canadians affected by the changes will have "ample time to make adjustments to their retirement plans."

For example, someone born in January 1958 will be eligible for OAS benefits in January 2023 at age 65, whereas an individual born in February or March, 1962 will not be eligible until 2029 at age 67. Anyone who is 54 years of age or older as of March 31, 2012 (born on or before March 31, 1958) will not be affected by the changes to the age of eligibility.

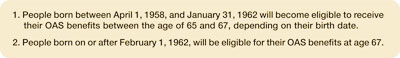

To assist in clarifying the above, the government provides the following information as to who will be affected by the change of eligibility from age 65 to 67:

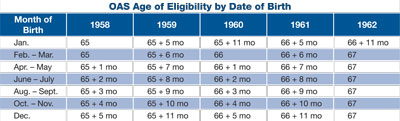

This chart explains how the new qualification age of 67 will be phased in over six years, between 2023 and 2029:

Voluntary Deferral of OAS Pension

Whereas arriving at a decision as to when to take your OAS gets a little more complex, it also presents more planning opportunities. We've now been given the opportunity to defer OAS for up to 5 years, starting on July 1, 2013, and to receive a higher, actuarially adjusted pension. For each month of deferral, 0.6% (7.2% per annum) will be added to the base pension, so that someone who postpones taking OAS for five years will receive a 36% higher benefit.

Clearly, the voluntary deferral of OAS is aimed at Canadians who continue to work past age 65, but there are a number of other scenarios where modeling your sources of income and cash flow needs should be done before you can make an informed decision. Let's take a look at a few of these.

In the past we were frequently asked the question when to start Canada Pension Plan (CPP) benefits. Typically it revolved around taking CPP at age 60 or postponing until 65. Now that question will be supplemented by "when is the best time to start OAS?"

For some the answer to this question may be "as soon as possible" if they are in real need of the income. For others it's not so simple. In the material accompanying the changes, the government mentions that "the adjusted pension would be calculated on an actuarially neutral basis, as is done with the Canada Pension Plan. This means that, on average, individuals will receive the same lifetime OAS pension whether they choose to take it up at the earliest age of eligibility or defer it to a later year".

Doing the math tells us that a 65 year old has to live past age 82 to draw more OAS in total than by deferring OAS until age 70, but this is at best a simplistic approach to the decision. For example, your health will be a factor in your decision. Someone with significant health challenges will likely want to enjoy OAS benefits sooner rather than later, perhaps if only because they do not continue to your survivor(s).

Your "tax zone", i.e. what marginal tax bracket you are in, is an equally important factor. OAS benefits are fully taxable and added to your other sources of income in determining your taxable income. Will the receipt of OAS push you into a higher bracket? How much of your OAS will you have left after-taxes? Both are important results to know in advance of your decision.

For retirees, there may be two other important tax considerations in deciding when to take OAS.

First, individuals age 65 and over are entitled to the "Age Amount" personal tax credit of $6,854 (2013) which reduces your tax liability. However, this personal tax credit is reduced by 15% of the amount of your net income in excess of $34,562 (2013). And, the entire Age Amount tax credit is lost at a net income level of $80,256 (2013). Receipt of OAS benefits could further erode this credit.

Secondly, many of you are aware that OAS benefits have to be repaid or "clawed back" at certain income levels. For 2013 OAS benefits are clawed back at the rate of 15% of net income in excess of $70,954, with 100% being clawed back at an income level of $114,640.

From the above you can see that whether it's a benefit reduction or a benefit "clawback", your effective tax rate can increase significantly, especially when your income crosses certain thresholds. Since receipt of OAS could have a negative effect on your current and future cash flow, controlling the type of investment income you receive (interest vs. dividends vs. capital gains) takes on greater importance, as does taking advantage of all possible opportunities, including pension splitting for couples.

One of the areas that we will be researching in the months ahead is the pros and cons of deferring OAS benefits in favour of making RRIF withdrawals earlier than age 72, or perhaps larger than government legislated minimum RRIF withdrawals. If OAS is deferred it's obvious that there would be no clawback of any RRIF income replacing it. And, for someone who has no private pension plan, RRIF withdrawals are eligible for a pension income credit on the first $2,000, thereby giving you more money in hand.

Taking this one step further, reducing the value of your RRIF before age 72 would mean that when you do start your OAS at age 70, your RRIF withdrawals would be based on a lower value, which could assist in reducing your OAS clawback. Bear in mind that for some of you the clawback of your OAS benefits is inevitable, but deferring your OAS might mean higher clawback thresholds down the road and less repayment of benefits.

Plan to discuss how these changes will impact you at your next meeting with your Polson Bourbonniere Certified Financial Planner. In the meantime, for more information regarding your CPP and/or OAS benefits you can visit www.servicecanada.gc.ca/retirement, or call 1-800-0-Canada.

|