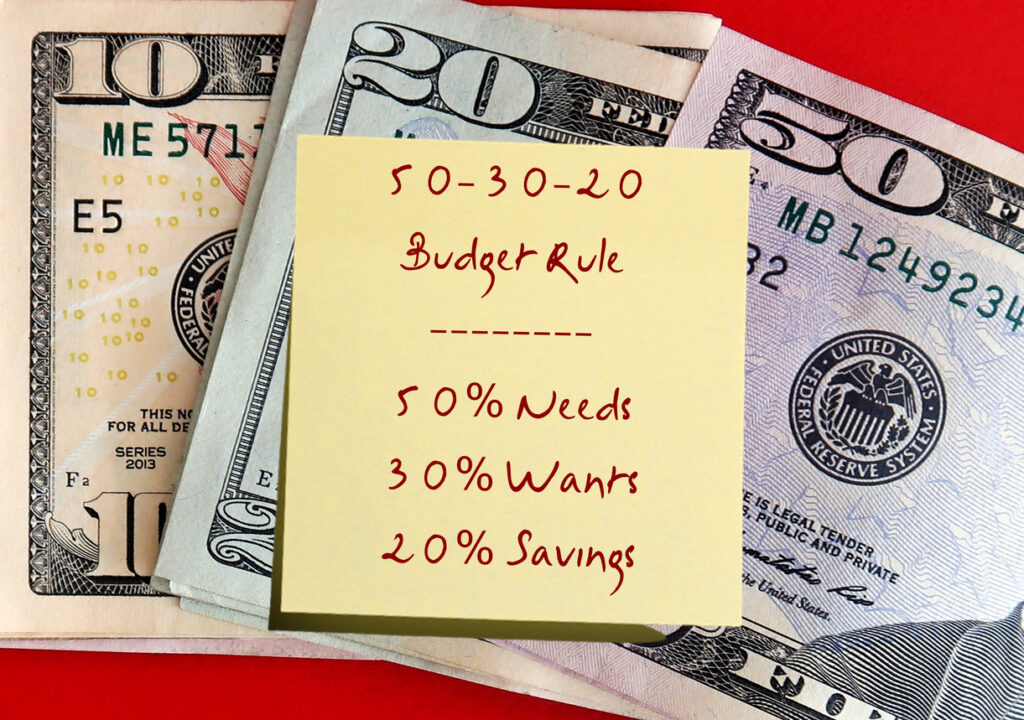

Managing your money effectively doesn’t need to be complicated. The 50/30/20 rule offers a mental model for personal finance that helps you live within your means while still enjoying life and building wealth.

What is the 50/30/20 Rule?

The 50/30/20 rule divides your after-tax income into three simple categories:

-

50% for needs: Essential expenses like housing, transportation, insurance, utilities, and groceries—the things you need to survive.

-

30% for wants: This is giving yourself permission to enjoy the journey through dining, travel, hobbies, and experiences.

-

20% for savings and debt reduction: Contributions to investments and extra payments toward debt beyond the minimum requirements.

The investments you make buy growth and income, with the long-term goal of replacing your need to trade time for money. Meanwhile, additional debt payments help you “skip steps” on your journey to becoming debt-free, saving you significant amounts of interest in the process.

Finding the Right Balance

While the rule provides a convenient structure, it’s important to view it as a guideline rather than a rigid requirement.

In expensive cities like Toronto or Vancouver, allocating only 50% to needs might be more aspirational rather than realistic.

We tend to avoid using the word budget because it can feel intimidating. That’s why the 50/30/20 approach works better as a guideline than a strict rule for most people.

That means the percentages can be adjusted based on your circumstances and goals. If you’re aggressively building wealth, maybe you’ll allocate 30% to investments and debt reduction and only 20% to wants. The key is maintaining awareness of all three categories.

Why It Works

At the end of the day, the 50/30/20 rule simplifies complex financial questions about how much to save and how to live in a disciplined way. It offers some key advantages:

-

It lets you enjoy life guilt-free (as long as you’re addressing debt and feeding investments)

-

It promotes consistent saving

-

It provides flexibility to adjust as your situation changes

-

It helps you identify when your financial situation needs attention

When your needs exceed 50% of your income, it signals that something may need to change—whether that means finding ways to increase your income or reduce expenses.

Getting Elevators Moving in Opposite Directions

One of the most powerful concepts in personal finance is getting your financial “elevators” moving in opposite directions—your assets increasing while your liabilities decrease. This combination accelerates net worth growth dramatically.

When you make extra payments on debt, for instance, you’re literally eliminating future payments. If you have 96 scheduled payments but consistently add extra principal each month, you might reduce that to 90, then 85, continually shortening the path to financial freedom.

Final Thoughts

Whether you’re just starting your financial journey or approaching retirement, the 50/30/20 rule provides a balanced framework that can help you enjoy today while building for tomorrow. The most important thing is getting started—because once you do, things start to snowball in the right direction.

Want to discuss the 50/30/20 rule or other smart ways to save and invest? Reach out to us anytime — we’re always here to help.